Click on each tab to view additional details of each

Click on each tab to view additional details of each

The Loan Master Files are the key to the rest of the system. The three screens for information pertaining to the loan and its terms keep all data that relate to the loans. Optional fields created by your agency allow you to track additional agency-specific items.

Characteristics of the loan such as jobs information, financing data, repayment terms, collateral type, use of funds, ethnicity, income levels, notes on the loan, escrow information are all kept in this main area.

Multiple funding sources for loans are easily handled within each loan. Using the loan fund selection option, you can select from unlimited user-defined funding source choices.

Drop down boxes are available for many fields making loan input quick and easy.

City, county, funding source, status, loan type, borrower type and loan officer are user-defined, therefore, are specific to your agency. These breakdowns allow for reports to be printed in many different ways.

GMS-RLSS has an internal security program that allows you to set up each user with access only to those areas they are authorized for.

A password is set up and selections are made for each area of the system. These include master files, reports, amortization, tools, and journal entries. It is also broken down by review, edit, and create where applicable.

Access to the database can be limited to one or two persons so that your system is safe and secure.

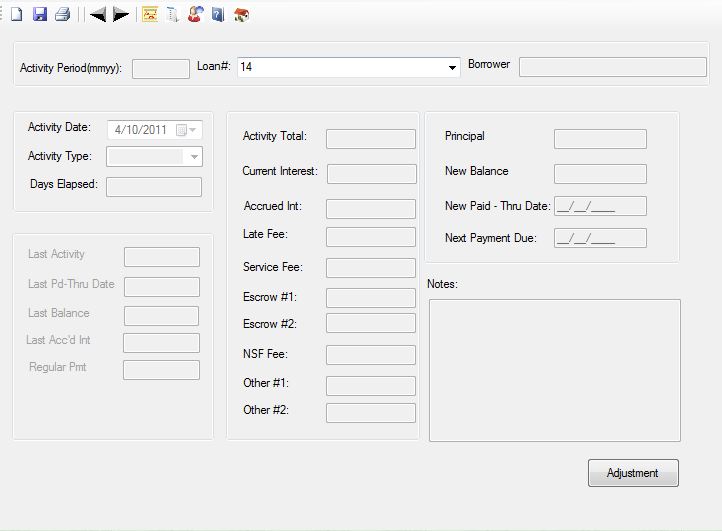

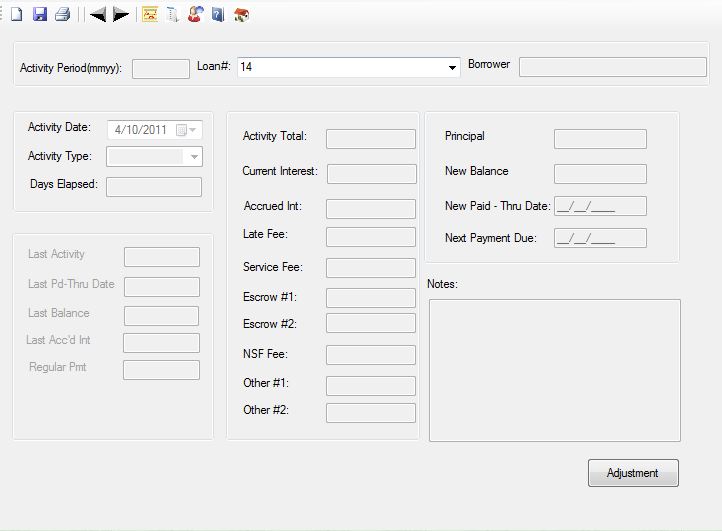

No function is more critical than keeping track of loan transactions – disbursements, repayments and escrows.

Loan Activity allows loan repayments to automatically be computed based upon terms established in the loan master file. Calculation of principal, interest, service fees, late fees and escrow amounts are automatic. If special terms apply, you always have the option to override the automatic calculations.

Two methods of interest computation are built into GMS-RLSS: calculation based upon an amortization table and calculation based upon number of days lapsed since last payment (daily interest method). These options are loan specific, allowing flexibility.

Also available is the ability to have certain loans on a 365 day schedule and others on a 360 day.

Monthly Activity Reporting

GMS-RLSS may be used as a subsidiary system to an accounting system – either the GMS Accounting and Financial Management system or another accounting system.

Many GMS clients use GMS-RLSS as a “stand-alone” system . They may be local or state government agencies, or other organizations who do not maintain their own accounting systems.

The Monthly Loan Transaction Activity Report is the key to reconciling with your accounting system each month, providing the data required to prepare a journal entry. This report also serves as the proof register for all transactions entered throughout the month.

The report lists all transactions posted in the given month in chronological order and then automatically summarizes them by fund totaling principal, interest, service fees, penalties, escrow amounts, special fees, loan disbursements and repayments.

Plus, you have the capacity to track additional loan costs that you do not wish to collect interest upon nor affect the principal balance.

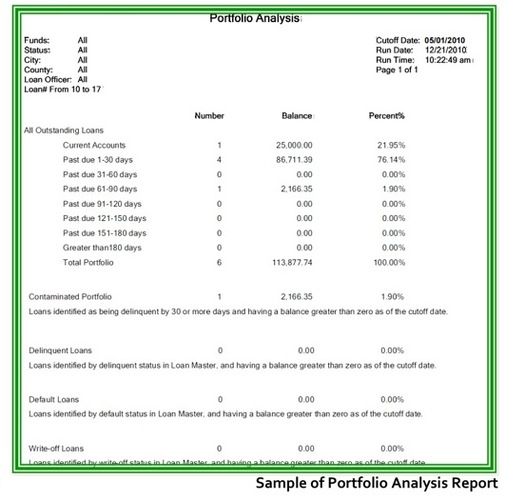

Reporting

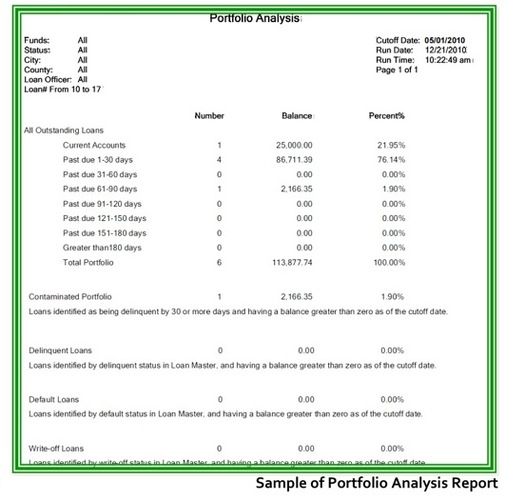

Reporting is very important to your agency, and is an intricate part or the GMS-RLSS system.

The reports menu puts the basic reports in one easy to use menu and makes retrieving information a snap.

Standard reports include: Loan Payment Status Report, Loan File Aging Report, Current/Non-Current Balances, Analysis by Fund, Accrued Interest Report, Borrower Profiles, Portfolio Statistics, and the Monthly Activity Report.

Every organization has its own information requirements. User defined Optional Fields in the master files allow you to track virtually any piece of information you may need in your everyday management or specific information for funding sources. All of this information is available to create reports using the Master File Query function (the report writer).

Additional “supplemental” reports and options can be purchased from GMS and allow each GMS client to select items that are specific to his or her agency needs.

The report can be displayed, printed or exported to any number of other software packages.

Amortization Schedules

Amortization tables can be computed for virtually any combination of terms, including special terms such as interest only or balloon payments. Different payment amounts throughout the loan term are also accommodated.

The table criteria may be saved under a loan number or name. This means an amortization table created during an application process can be retained for use if the loan is granted and modified if needed for any purpose.

Additional Features

Additional Features within the RLSS system include Auto Rate Change, Conversations, Loan Coupons, Late Payment Notices, Loan Catch up and Payoff, Quick Date Listings, Acknowledgement forms and Line-of-credit Payment Recalculation.

Beyond the basic GMS-RLSS system, there may be some other things you would like the system to do to fit your agency’s needs. This is where the supplemental pieces come in.

There are a number of additional items you can add at any time to meet your needs.

Creating these supplements allows us to keep the software costs down as not all agencies utilize the following items. Examples of these are available in our Sample Reports that you will find under the Reports section.

These include:

The Loan Master Files are the key to the rest of the system. The three screens for information pertaining to the loan and its terms keep all data that relate to the loans. Optional fields created by your agency allow you to track additional agency-specific items.

Characteristics of the loan such as jobs information, financing data, repayment terms, collateral type, use of funds, ethnicity, income levels, notes on the loan, escrow information are all kept in this main area.

Multiple funding sources for loans are easily handled within each loan. Using the loan fund selection option, you can select from unlimited user-defined funding source choices.

Drop down boxes are available for many fields making loan input quick and easy.

City, county, funding source, status, loan type, borrower type and loan officer are user-defined, therefore, are specific to your agency. These breakdowns allow for reports to be printed in many different ways.

GMS-RLSS has an internal security program that allows you to set up each user with access only to those areas they are authorized for.

A password is set up and selections are made for each area of the system. These include master files, reports, amortization, tools, and journal entries. It is also broken down by review, edit, and create where applicable.

Access to the database can be limited to one or two persons so that your system is safe and secure.

No function is more critical than keeping track of loan transactions – disbursements, repayments and escrows.

Loan Activity allows loan repayments to automatically be computed based upon terms established in the loan master file. Calculation of principal, interest, service fees, late fees and escrow amounts are automatic. If special terms apply, you always have the option to override the automatic calculations.

Two methods of interest computation are built into GMS-RLSS: calculation based upon an amortization table and calculation based upon number of days lapsed since last payment (daily interest method). These options are loan specific, allowing flexibility.

Also available is the ability to have certain loans on a 365 day schedule and others on a 360 day.

Monthly Activity Reporting

GMS-RLSS may be used as a subsidiary system to an accounting system – either the GMS Accounting and Financial Management system or another accounting system.

Many GMS clients use GMS-RLSS as a “stand-alone” system . They may be local or state government agencies, or other organizations who do not maintain their own accounting systems.

The Monthly Loan Transaction Activity Report is the key to reconciling with your accounting system each month, providing the data required to prepare a journal entry. This report also serves as the proof register for all transactions entered throughout the month.

The report lists all transactions posted in the given month in chronological order and then automatically summarizes them by fund totaling principal, interest, service fees, penalties, escrow amounts, special fees, loan disbursements and repayments.

Plus, you have the capacity to track additional loan costs that you do not wish to collect interest upon nor affect the principal balance.

Reporting

Reporting is very important to your agency, and is an intricate part or the GMS-RLSS system.

The reports menu puts the basic reports in one easy to use menu and makes retrieving information a snap.

Standard reports include: Loan Payment Status Report, Loan File Aging Report, Current/Non-Current Balances, Analysis by Fund, Accrued Interest Report, Borrower Profiles, Portfolio Statistics, and the Monthly Activity Report.

Every organization has its own information requirements. User defined Optional Fields in the master files allow you to track virtually any piece of information you may need in your everyday management or specific information for funding sources. All of this information is available to create reports using the Master File Query function (the report writer).

Additional “supplemental” reports and options can be purchased from GMS and allow each GMS client to select items that are specific to his or her agency needs.

The report can be displayed, printed or exported to any number of other software packages.

Amortization Schedules

Amortization tables can be computed for virtually any combination of terms, including special terms such as interest only or balloon payments. Different payment amounts throughout the loan term are also accommodated.

The table criteria may be saved under a loan number or name. This means an amortization table created during an application process can be retained for use if the loan is granted and modified if needed for any purpose.

Additional Features

Additional Features within the RLSS system include Auto Rate Change, Conversations, Loan Coupons, Late Payment Notices, Loan Catch up and Payoff, Quick Date Listings, Acknowledgement forms and Line-of-credit Payment Recalculation.

Beyond the basic GMS-RLSS system, there may be some other things you would like the system to do to fit your agency’s needs. This is where the supplemental pieces come in.

There are a number of additional items you can add at any time to meet your needs.

Creating these supplements allows us to keep the software costs down as not all agencies utilize the following items. Examples of these are available in our Sample Reports that you will find under the Reports section.

These include: