E-NEWS DECEMBER

Important first-time 1095-C e-filers!

The regulation mandating the electronic reporting of more than ten forms applies to you. You must apply for a Transmitter Control Code (TCC) (as a transmitter). If you are e-filing forms for the 1095s and 1099s/1098s, please note that TCC differs. Ensure that you have the associated TCC required for the appropriate form.

To obtain the TCC associated with 1095s, you must establish an ID.me account to access the IRS e-Services site for online applications.

In prior years, obtaining the TCC was detailed and arduous. We at GMS cannot guarantee an improvement in the timeline for getting your TCC. We strongly encourage first-time ACA e-filers to act now.

You can find essential information on the required steps on the IRS website: https://www.irs.gov/e-file-providers/air/apply-for-the-affordable-care-act-application-for-transmitter-control-code-tcc

ACA Application for TCC: https://www.irs.gov/tax-professionals/affordable-care-act-aca-services

Additional information addressing the Affordable Care Act Information Returns (AIR): https://www.irs.gov/e-file-providers/affordable-care-act-information-returns-air

As the IRS website informs, first-time e-filers will be in the ACA Assurance Test System (AATS) Test Environment. You must successfully upload their ACA Test File in this Test environment.

Our GMS software provides the ACA Test file, which can be seamlessly obtained by selecting tools on your software menu and selecting from the option ‘Create ACA Test File.’ Note the path of the ACA test file in the confirmation message upon its creation. Refer to your help manual for additional details.

On the ACA test environment (AATS), and upon successful confirmation of your test submission, you must correspond with the IRS to move you into the User Interface (UI) Production System production environment. This environment will be where your ACA efile will be processed.

Note* If you are not a first-time ACA e-filer, you are already in the production environment and will not need to repeat the process.

Please help us service you BEST!

To ensure that your organization is promptly informed about software updates and receives timely notification, GMS must have the correct contact information including email addresses for those who will be responsible for receiving GMS revisions.

If you have gone through staff changes and have yet to notify GMS of the new contacts responsible for receiving updates, please do so by completing the client update request: https://www.gmsactg.com/client-update.

Streamline your Year-End Processing with Our Latest On-Demand Webinar: Calendar YE Processing W2s & 1099s

As the calendar year ends, we are gearing up for one of the most critical yet often challenging tasks—Year-End Processing of W-2s and 1099s. To navigate the complexities of this preparation and ensure a smooth transition into the new year, our latest on-demand webinar, ” Calendar YE Processing W2s & 1099s,” is your go-to resource for insight and practical guidance.

Our on-demand webinar equips you with the knowledge and tools to streamline the entire process.

Understand the requirements on the new regulation (Tax Payer First Act), ensuring your organization remains compliant and avoids costly penalties. Obtain access to the Q&A Session where specific questions address pertinent topics to your process.

The on-demand format allows you to access the webinar conveniently. Whether you prefer to binge-watch the entire session or break it down into manageable chunks, you can learn at your own pace within a period of 30 days.

Click below to the client resource page under the category, webinars, and complete your on-Demand registration.

Note:

Important Deadline in January

The deadline for submitting databases to GMS for Tax Form Printing is January 19, 2024.

Tax Form Shipping Announcement

Shipping has begun for blank tax forms to those clients that will be printing forms from their offices.

· Please anticipate delivery of your orders by the end of the third week in December.

· Tracking information will be emailed by UPS to the email address on the order form.

· Upon receipt of your package, we recommend immediately opening the package and verifying that the contents received are correct. Please email service@gmsactg.com if there are any discrepancies.

Very Important!

Please do not begin printing tax forms prior to installing the Software revision that will be released in the last week in December.

This December revision should be installed AFTER the last paychecks dated in December 2023 have been processed and before the first paycheck dated in January 2024.

Note: Tax Form order’s received after 12/31/2023 will incur a $10.00 late processing fee. Please await the latest revisions scheduled for December before commencing printing.

Software Revisions to be released in December

RLSS Software revision is planned to be released on

Monday, December 11th.

Accounting Software revision is planned to be released on

Thursday, December 28th.

A Note about the Revisions

Please read the instructions carefully when you receive the software revisions email as it will explain in detail the correct time to install the software updates. Timing is critical for these specific revisions and important these revisions are installed.

Do you need to write “One time” checks to Employees?

-

There are two ways to accomplish processing one-time checks

-

A timesheet adjustment(s) will need to be completed.

You will enter the element to be charged, 0 hours, and the gross dollar amount.The timesheet adjustment(s) are then processed through payroll. You will process the TI adjustment batch through payroll, starting at the leave menu. When you get to the prepare payroll step, consider if you will be withholding any deductions or special pay. To turn off either of those, remove the check mark. If you chose not to Include All deductions, you will have the option to choose the deductions to be withheld. After proofing the payroll and deduction register, you may then continue and finish the payroll processing menu.

OR

-

If taxes need to be adjusted, enter a payroll adjustment for each employee with the gross, taxes and any deductions as positive amounts. Do Not enter a check number, date, nor check the PADJ box.

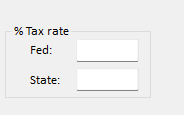

IRS Publication 15 page 19 describes supplemental wages and 2 choices on how to calculate the federal tax to be withheld. To accomplish this in a payroll adjustment, after the gross wages and any deductions have been entered, click on Calculate Tax. To withhold a flat %, put the percentage amount in the Fed: field. The amount previously calculated will change. If your state has the same regulation on taxes for supplemental wages, enter the percentage in the State: field. The previously calculated tax will change.

To run payroll with just the PR adjustment, go to the prepare payroll step and prepare payroll. Complete the rest of the payroll menu.

If you have entered a payroll adjustment for each employee, you will need to also enter a TI adjustment (as stated in 1.) The TI adj batch will NOT be run through payroll and you will post the TI batch, in Tools, Post Timesheet batch.